On 4th

November, the China Association for Quality (CAQ) has published the 2016 National Consumer Satisfaction Research

on Liquid Milk. The study reveals, that the satisfaction of Chinese

consumers is decreasing, compared to 2015 and demands for the quality of milk are

changing. Suppliers have to be prepared for the changing needs of their Chinese

customers.

Source: www.cnchemicals.com/

The

results of the research can be summed up in four main points, according to CCM.

The first trend shows, that characteristics like consumer satisfaction, brand

image, and perceptual quality are all decreasing in the survey, namely 1 point,

1 point, and 2 points respectively. This slight fall doesn’t seem to be

important, nevertheless it is showing a trend that should be seen as a signal

for milk selling companies. Consumers are attaching more value to quality and

reputation of the milk. The research also states, that consumers respond little

to Sales promotion in general and be negatively affected by price hikes, which

lowers their satisfaction levels again.

Another

result of the report is the high popularity of fresh milk and UHT milk among

the Chinese consumers. The benefit of UHT milk is caused in the insurance, that

the high temperature sterilization provides a long shelf life and kills

dangerous bacteria. This guarantees a well fit into the modern life style of a

growing number of Chinese customers. Therefor, 31.2% of those questioned prefer

the UHT milk, according to the report. The second highest preference belongs to

fresh milk. The main benefit hereby results of the higher nutritional value in

fresh milk. Also notable is the rising taste of formulated milk such as

flavored milk, namely chocolate milk and vanilla milk.

The

third point of the most important results contains the high preference of

liquid milk over milk power. This is explained with the rich nutritional

properties in liquid milk. The main nutritional is calcium.

The

last result deals with the distribution preference. According to the survey,

almost 90% of the participants like to buy their milk in the good old

supermarket. The next choices are convenience stores and also delivery by the

manufacturers directly. Although the market of online purchases is growing in

general, for milk this is only a weak distribution share. Less than 2% of the

milk is purchased via E-commerce, according to the report. The supermarket

still represents the most convenient place to get the daily doses of calcium

for the Chinese consumers.

Suppliers

of milk should have these changes in mind, when promoting and selling their

milk brands in the Chinese market. It is true the consumption of liquid milk

has a slower growth in general the last years, but the changing preferences are

for sure an opportunity for milk suppliers to approach the Chinese changing

needs and ensure the share of their milk brands in the Chinese market.

The

China Association for Quality released the research on 4th November for the

sixth time since 2011. The investigation contains surveys of more than 9,000

Chinese consumers from 31 provinces in whole China. Those questioned could

select between 31 brands and the surveys were carried out online and on phone

interviews. In the survey, it is possible to rate between 0 (complete

unsatisfied) and 100 (complete satisfied) points. The average value of the

points was 74, a four percent loss compared to the value of 2015.

Source CCM, China Association for Quality

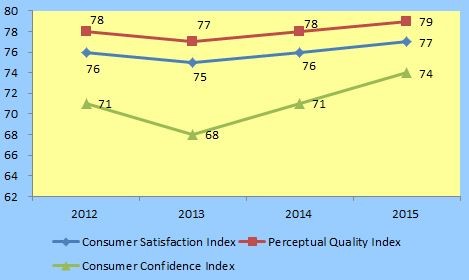

The

graphic shows the development from 2012 to 2015. The index is separated into

three fields: Consumer Satisfaction Index, Perceptual Quality Index, and

Consumer Confidence Index and shows the industry average of those. According to

the figure, all three areas had the lowest value in 2013 and were growing

constantly since then. In the newest report from 2016, there will be another

fall in the satisfaction value, as discussed earlier.

About CCM:

CCM is the leading market intelligence provider

for China’s agriculture, chemicals, food & ingredients and life science

markets.

Do

you want to find out more about the dairy Market in China? Join our

professional online platform today and get insights in Reports,

Newsletter, And Market Data at one place. For more trade information on dairy

visit our experts in trade analysis to get your insights today.

Tag: dairy